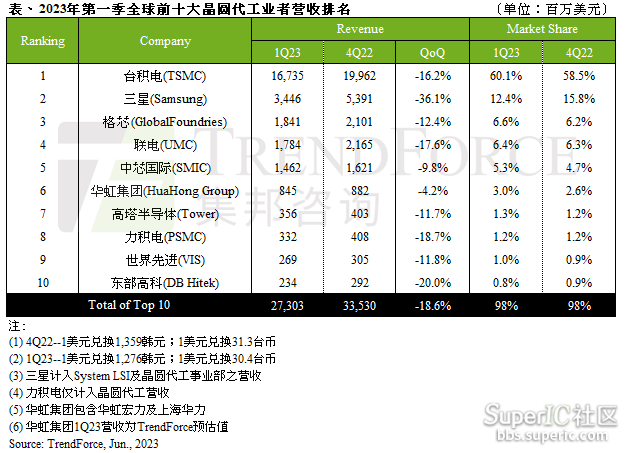

TrendForce: The revenue of the top ten wafer foundry manufacturers in the first quarter decreased by nearly 20% month on month, and will continue to decline in the second quarter

According to TrendForce consulting research, the revenue of the world's top ten wafer foundries in the first quarter decreased by 18.6%, approximately $27.3 billion, due to the continued weakness of terminal demand and the multiplier effect of off-season. The biggest change in this ranking is that GlobalFoundries surpassed UMC to third place, and Tower Semiconductor surpassed PSMC and VIS to seventh place this season.

The utilization rate of production capacity and shipment volume have decreased simultaneously, and the decline in revenue has expanded

The production capacity utilization and shipments of the top ten wafer foundry manufacturers in the first quarter both decreased. TSMC's revenue in the first quarter was 16.74 billion US dollars, a decrease of 16.2% compared to the previous quarter. Due to weak demand for mainstream applications such as laptops and smartphones, the production capacity utilization of 7/6nm and 5/4nm significantly decreased, with revenue decreasing by more than 20% and 17% compared to the previous quarter, respectively. The second quarter is expected to briefly benefit from urgent order demand, but capacity utilization remains low, and it is expected that revenue will continue to decline in the second quarter, with the quarterly decline converging compared to the first quarter.

Samsung's 8-inch and 12-inch production capacity utilization rates have both declined, with revenue of only $3.45 billion in the first quarter, a decrease of 36.1% compared to the previous quarter, making it the industry with the highest decline in the first quarter. At present, there is a return of sporadic component orders in the second quarter, but most of them come from short-term inventory replenishment rather than signals of terminal demand strengthening. It is worth noting that some 3nm new product output will officially contribute to revenue in the second quarter, and it is expected that the quarterly decline will slow down. Gexin's first quarter revenue was $1.84 billion, a decrease of 12.4% compared to the previous quarter. Since the reversal of market conditions in the second half of last year, orders from domestic automotive, defense, industrial control, and government in the United States have supported Gexin's stable operation. In the first quarter of this year, its revenue officially surpassed Liandian and took third place. In the second quarter, due to stable orders from industrial control IoT, aerospace defense, and automotive, it will support the performance of Gexin's capacity utilization. It is expected that revenue will be roughly the same as in the first quarter.

Liandian's revenue in the first quarter decreased by 17.6% month on month, to approximately $1.78 billion, with revenue at 28/22nm and 40nm dropping by about 20% or more respectively. In the second quarter, due to customer cuts such as PMIC and MCU, the utilization rate of eight inch production capacity will drop to below 60%; Twelve inches are benefiting from the support of urgent orders at 28/22nm, such as Tcon and TV SoC, with a capacity utilization rate of about 80%. At the same time, the average sales unit price is stable, and it is expected that revenue can remain stable or slightly increase. In the first quarter, SMIC's revenue decreased by 9.8% month on month, about $1.46 billion, of which the eight inch revenue decreased by nearly 30% month on month, while the twelve inch revenue slightly increased by 1-2% month on month due to the diversified product portfolio and the support of domestic demand in Chinese Mainland. In the second quarter, thanks to the recovery of some orders and the advantages of domestic demand in Chinese Mainland, such as Driver IC and Nor Flash, shipment and capacity utilization are expected to increase, and revenue is expected to return to growth.

The market situation for consumer products is sluggish, with Li Ji Dian and the world's advanced revenue bearing the brunt

Since the second half of 2022, the wafer foundry industry has been declining. Second and third tier wafer foundry manufacturers are limited by process technology and high product overlap, resulting in fierce competition and a lack of bargaining power. Therefore, their operational performance has changed more sharply in the context of a downward demand reversal. The biggest change in the top six to ten in the first quarter was for Gaota Semiconductor, which rose to seventh place. Based on the support of European market demand, revenue fell 11.7% month on month, about $360 million, with a slight decline compared to most second and third tier OEM factories.

Although Li Ji Dian benefited from some of the LDDI inventory replenishment momentum related to television, the revenue of the HV process increased by about 26% month on month, other platform products such as PMIC and Power discrete are still undergoing inventory correction, and customer investment attitudes tend to be conservative. The first quarter revenue was approximately $330 million, a decrease of 18.7% month on month. Due to the size and size of DDI customers in the world, their inventory has gradually become healthy, and the production volume has begun to recover, while the production status of PMIC is also poor. The first quarter revenue was approximately $270 million, a decrease of 11.8% compared to the previous quarter. Other businesses such as HuaHong Group had a revenue of approximately $850 million in the first quarter, a decrease of 4.2% compared to the previous quarter; DB Hitek's revenue was approximately $230 million, a decrease of 20% compared to the previous month.

TrendForce Consulting expects that the output value of the top ten wafer foundry manufacturers in the second quarter will continue to decline, and the quarterly decline will converge compared to the first quarter. Although in response to the peak demand in the second half of the year, the supply chain should mostly start stocking in the second quarter. However, after the market situation has reversed, the supply chain inventory has accumulated and is currently slowly being depleted. Most customers remain cautious in stocking, which has eased the wafer foundry production cycle in the second quarter compared to before. Only sporadic urgent orders such as TV SoC, WiFi6/6E, TDDI, etc. have limited overall capacity utilization growth.

Share